From diesel subsidies to SLD rules, here are 5 priorities for Malaysian operators when purchasing new trucks in 2025.

Defining the Best Truck for Malaysian Operators

Buying a new truck in Malaysia, or Southeast Asia for that matter, has never been more complex. Beyond horsepower and badge prestige, operators now face shifting fuel policies, tightening safety rules, and changing infrastructures.

In June 2024, the Malaysian government ended blanket diesel subsidies, setting the retail price at RM3.35 per litre in Peninsular Malaysia, with targeted cash subsidies (Sistem Kawalan Diesel Bersubsidi/SKDS) for eligible users.

One year later, in 2025, the B20 biodiesel pilot for ground support equipment (GSE) was launched at Kuala Lumpur International Airport (KLIA) to promote green energies. Meanwhile, around the same time, the Ministry of Transport (MoT) has mandated all heavy commercial vehicles be fitted with Speed Limiter Devices (SLD) by 1 October 2025, along with several other safety requirements such as proper wiring, seatbelts, GPS, and CCTV.

Tolling is also evolving. The government has announced Multi-Lane Free Flow (MLFF) systems using RFID and ANPR cameras to eliminate congestion at toll plazas. Recently, Prime Minister Anwar Ibrahim has also announced that the federal government is planning to build new roads. This means commercial vehicle operators are most likely to face fewer external hurdles in the future, and, therefore, responsibilities will shift more heavily onto how well fleets are managed, from choosing the right trucks and maintaining them properly to ensuring compliance with new fuel and safety standards.

So, what exactly do operators need to consider when choosing the right trucks for them?

1. Total Cost of Ownership (TCO)

A truck’s price only tells half the story, because operators must still consider financing, fuel consumption, maintenance cost, downtime, parts availability, and also resale value. This is why owning a truck must be analysed through the lens of Total Cost of Ownership (TCO).

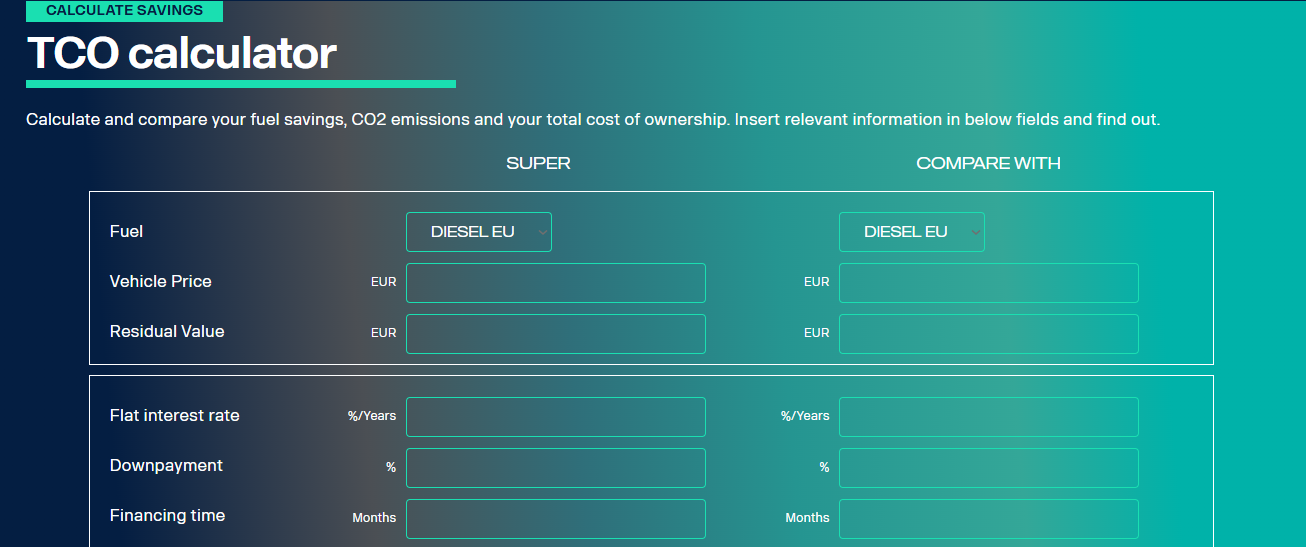

Manufacturers understand this situation, and Scania, for example, has introduced a TCO calculator that allows operators to model long-term costs, factoring in fuel efficiency, service intervals, and emissions.

For operators, requesting a TCO worksheet from your dealer is non-negotiable. However, the work should not stop there because you still have to stress-test the numbers against different fuel price assumptions. With diesel price already at RM3.35/L without subsidy, a ±5–10% difference could significantly affect fleet budgets.

2. Fuel Efficiency, Emissions, and Biofuel Readiness

Fuel remains the single biggest running cost for most fleets, which is why efficiency is often the first priority in any purchasing decision. For light- and medium-duty trucks, Isuzu’s ELF and Forward models are still regarded as the most fuel-efficient in their classes. That efficiency has been one of the main reasons why Isuzu has remained Malaysia’s most popular truck brand for 15 consecutive years, with the ELF and Forward at the heart of that success.

Beyond efficiency, operators also need to look at emissions compliance. Malaysia now requires all commercial vehicles to meet Euro 5 standards. Hino marked a significant milestone in June 2025 when it launched its first locally assembled Euro 5 light commercial vehicle, giving operators new options that are both compliant and future-ready.

Aside from Isuzu, UD, Fuso, and Hino, Chinese brands such as Foton, Shacman, and Sinotruk have also introduced their Euro 5 trucks. Shacman, for instance, introduced its Euro 5 – X Series in mid 2024. Foton then followed suit by introducing the Auman R Euro 5 in December 2024 and Sinotruk launched Hohan and Howo Euro 5 in 2025.

Finally, fuel compatibility is also something to be considered. Right now, Malaysia’s planned shift to B20 biodiesel is still at the pilot phase. However, this shows the country’s intention to switch to a cleaner fuel and, therefore, operators need to ensure that their chosen trucks are warranted for higher biodiesel blends once nationwide implementation takes place.

In short, a truck that offers strong fuel economy, meets Euro 5 standards, and carries warranty coverage for higher biodiesel blends will be best positioned for the Malaysian market.

3. Uptime, Service, and Support

Downtime can erase thin margins, and operators increasingly value after-sales support that can minimise it. The logic is, indeed, simple: the longer a truck is in operation, the faster it pays itself out.

Scania ties its flexible maintenance schedules to telematics data, optimising service intervals to reduce unplanned stoppages. MAN and Fuso build their sales pitch around strong regional networks that give operators predictable coverage across Malaysia and Singapore. Mercedes-Benz and Isuzu also emphasise their dealer presence, with the goal of reducing detours.

Distributors like Angka-Tan (Foton), Hong Seng (Sinotruk Hohan), SMHE (Sinotruk Howo), and YonMing (Shacman) also have wide aftersales coverage.

The key lesson here is to push dealers for more than just a maintenance schedule. Operators should ask more about average parts lead times, the availability of mobile service units, and warranty terms that minimise the risk of extended downtime.

4. Safety, Comfort, and Compliance

As mentioned above, reducing accidents is now of utmost priority in Malaysia. Malaysia’s SLD regulation makes compliance a legal necessity, while Advanced Driver Assistance Systems (ADAS) are increasingly expected in modern fleets.

Scania‘s Euro V ADR trucks, which have been delivered to several Malaysian operators, demonstrate the benchmark. The truck itself offers Advanced Emergency Braking (AEB), Lane Departure Warning, and Electronic Stability Program (ESP) as part of its package.

Mercedes-Benz trucks emphasise a premium cabin, combined with assist technologies that improve both safety and driver comfort. At a different point in this spectrum, Hino‘s 300 and 500 Series focus on robust braking systems and ergonomic cabs, which make them suited to city and regional work where driver fatigue and quick response times are critical.

What matters for operators here is not who has the flashiest brochure, but whether the safety systems integrate smoothly with Malaysia’s SLD and safety requirements, and whether they provide tangible benefits for legal compliance and driver retention.

5. Fit-for-Purpose Design and Flexibility

The “best” truck is the one that matches an operator’s needs, whether it’s routes, payloads, and even business model. Overspending on a heavy-duty prime mover for city deliveries is as wasteful as under-specifying a light-duty truck for a long-haul freight. In practice, fit-for-purpose really means choosing the right duty class, then tailoring it through available options and accessories.

Isuzu ELF and Hino 300 Series dominate the light-duty segment thanks to their sizes, manoeuvrability, and efficiency for urban logistics. They also come with multiple body options, from box, crew cab, to refrigerated, making them adaptable to everything from e-commerce parcels to fresh food distribution.

In the medium-duty category, the UD Croner, the Isuzu Forward, and Hino 500 Series balance payload with versatility. These trucks can be personalised with different wheelbases, cargo bodies, and accessory packages for various purposes from regional distribution, construction, to utility work.

Lastly, for heavy-duty applications, prime movers such as the Hino 700 Series, UD Quester, Foton Auman R, Sinotruk Hohan, Fuso heavy trucks, and Mercedes-Benz Actros (the latter two distributed in Malaysia by Hap Seng Trucks Distribution) are the natural fit. Here, personalisation means choosing the right driveline, axle configuration, and comfort features to optimise performance on long hauls and high-capacity freight.

By considering both the duty class and the available personalisation options, operators can ensure they are not just compliant and efficient but also equipped with trucks that are tailored for their exact operating conditions.

Conclusion

In 2025, the “best truck” is not about the brand, but the one that delivers the lowest verified total cost of ownership, meets Malaysia’s (or other countries’) evolving fuel and safety rules, minimises downtime, and keeps drivers safe and comfortable.

Whether you are considering Scania, MAN, Fuso, Hino, Mercedes-Benz, Isuzu, Foton, Sinotruk, or any of the other brands available in the Malaysian market the smartest path is to create a neutral comparison checklist across these five key areas: TCO, fuel, uptime, safety, and fit-for-purpose. By prioritising these factors, transport operators can build fleets that not only meet today’s challenges but also stand ready for the regulatory and cost realities of tomorrow.